The All-New Solidarity Digital Banking is Here!!!

We’re excited to introduce a major upgrade to Solidarity’s Digital Banking—built with you in mind. Banking should be simple, secure, and convenient, so you can focus on what matters most in life. Our new online and mobile banking platform delivers a modern, easy-to-use experience with powerful tools to help you manage your money anytime, anywhere.

Please note that with any transition, you may encounter some issues, please be patient as we work though them!

Please note for iPhone users, you may need to manually update your app.

- Your Solidarity member number or 16-digit Solidarity debit card number.

- The last 4 digits of your social security number.

- Your date of birth.

- Current cell phone number and email address.

- For business accounts, please have the last 4 digits of your TIN.

Bill Pay registration and data: You won’t need to re-register for bill pay, and your payees and payment history will remain intact.

Bill Pay processing: Bill pay does not process on weekends. There will be no processing impact for you during the conversion — everything will occur after processing is complete.

Remote Deposit Capture (RDC): You won’t need to re-register, and your check deposit history will be maintained.

Scheduled transfers, external payees, member-to-member transfers, and hidden accounts: All of these will be converted, but because parts of the process are manual, please verify that your information converted properly.

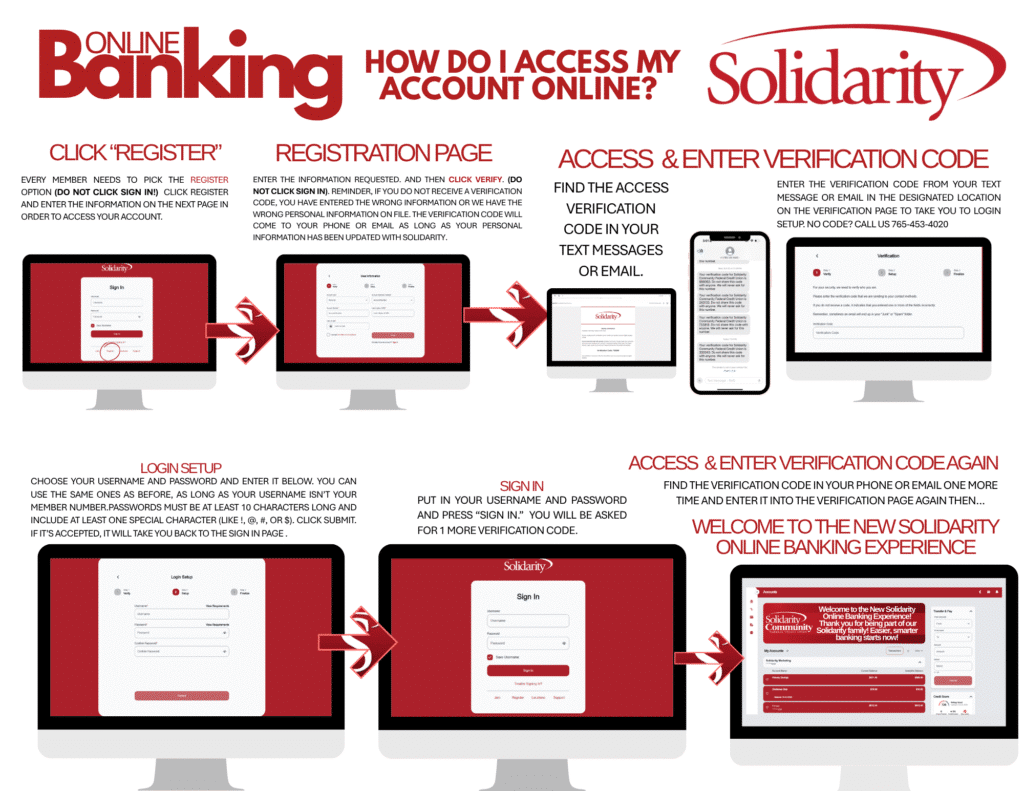

Online Registration

Visit solfcu.org and click Register in the login box on the homepage.

➡️ Important: Tap REGISTER to begin — do not click “Sign In” or “Trouble Signing In.” Remember, Register is the key word!

On the next page, enter your personal information, then click “I accept the terms and conditions” followed by Verify.

Have your personal information ready to go

- Your Solidarity member number or 16-digit Solidarity debit card number.

- The last 4 digits of your social security number.

- Your date of birth.

- Current cell phone number and email address.

- For business accounts, please have the last 4 digits of your TIN.

If we have your correct email address and cell phone number on file, you’ll receive a text message or email with your verification code.

If you do not receive a code, that means we do not have your correct contact information. Please call 765-453-4020 or stop by either location to update your details.

Once verified, you’ll be prompted to create your login credentials.

- You cannot use your member number as your username.

- You may use your previous online banking username if it is not your member number.

- No member numbers will be accepted as usernames.

After logging in, you should see your current account details. Please review them carefully to ensure everything is correct.

You only need to register once. If you register through the website, you’ll use those same credentials to log in through the Mobile App.

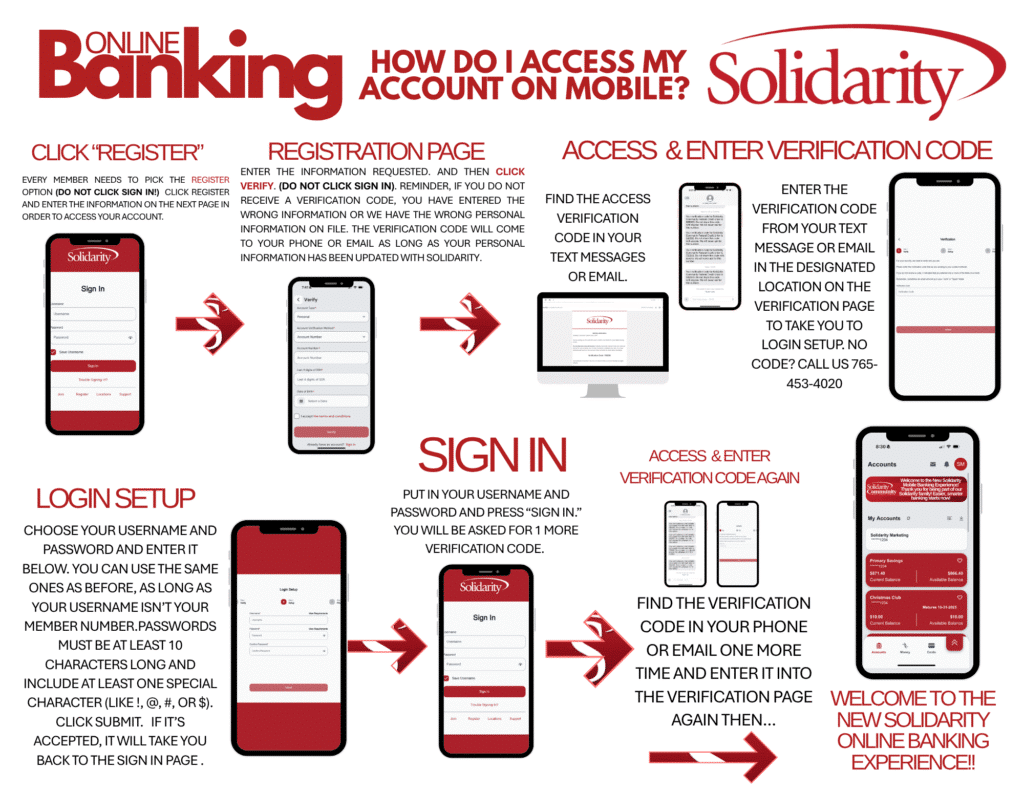

Mobile Registration

Mobile App Registration: You’ll know it’s the updated app if you see the red icon with a white S.

- iOS (Apple) Users: Update your existing Solidarity mobile app when the new version becomes available in the App Store.

- Android Users: Download the new Solidarity Mobile App from the Play Store.

To begin registration, open the app and tap the “More” icon in the bottom right corner. Then tap Register to start the process.

➡️ Again, do not click “Sign In” or “Trouble Signing In.” The word to remember is Register.

Enter your personal information, click “I accept the terms and conditions,” and then select Verify.

If we have your correct contact information, you’ll receive a verification code via text or email.

If you do not receive a code, please call 765-453-4020 or visit a branch to update your contact information.

Once verified, you’ll be prompted to enter your login credentials for the first time.

- You cannot use your member number as your username.

- You may use your old username if it’s not your member number.

After logging in, you should see your current account details; please take a moment to verify their accuracy.

Important Notice for Quicken & QuickBooks Users

If you currently using Quicken or QuickBooks with Solidarity’s online banking, please review these important steps:

Access is now unavailable until October 27, 2025 during the system transition.

Before October 24th at 5 P.M., 2025, you will need to:

Disconnect Quicken/QuickBooks from our current online banking.

Wait to reconnect until after our new system is live.

Please note: Quicken has a five-day blackout period following go-live. That means connections to the new digital banking platform may not be available until November 1 or November 2, 2025.

Taking these steps ahead of time will ensure your Quicken and QuickBooks continue working smoothly once access is restored.

Why The Upgrade?

When is the transition happening? The transition will take place on October 27th. Members will need to ensure their contact information is up to date before then to avoid any access issues.

What is my account number, and where can I find it? Your membership number, or account number as it’s commonly referred to, can be found on your account opening documents. If you need assistance, stop by either location and we will be happy to help!

Will this affect my online banking access? Will I need to re-register, or will my current login details be transferred over? Yes, all members must re-register for the new digital banking system. Existing usernames and passwords will not carry over. Don’t worry—the process is simple! You will not be able to use your member number as your username. Your account details will remain the same.

Will my member-to-member, account-to-account, and scheduled transfers be imported into the new system? Yes, all transfers will be imported into the new system. If you notice an issue, please call 765-453-4020

Why do I need to update my information? If we don’t have your correct login information, we can’t send you the necessary verification codes needed to re-register.

What happens if I don’t update my contact information? If your details are outdated, you will not receive the verification codes needed to re-register. You will need to call 765-453-4020 during our regular business hours or stop by either location to update your info. Don’t forget your ID!

How will you keep me notified during this process? We will send updates through multiple channels:

- Emails – Regular updates will be sent to all members.

- In-Branch Signage – Informational posters will be displayed in our branches.

- Website & Social Media – Updates and reminders will be shared online.

- Mobile Banking Alerts – Notifications will appear in the current online banking system.

FAQs

- Intuitive User Interface

Our redesigned platform is clean, modern, and easy to use. Whether you’re tech-savvy or just getting started, you’ll find navigating our new digital banking a breeze. - Enhanced Mobile App

Bank anytime, anywhere! Our upgraded mobile app mirrors the desktop site for a consistent, reliable experience with improved responsiveness and new features. - Advanced Security

Your security is always our top priority. The new platform uses the latest technology to keep your transactions and sensitive information safe—giving you peace of mind. - Personalized Financial Insights

Get a deeper understanding of your finances with smart tools and analytics. Tag your purchases, set alerts, and track your goals to help you make informed decisions.